eSmart Tax Guarantees

We're committed to delivering the highest quality tax experience possible. Our guarantees are the reason why we're part of the trusted Liberty Tax Service family.

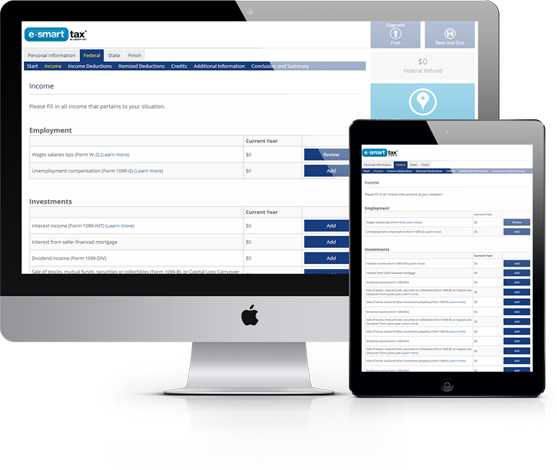

Check Out These Amazing Features

Save time and improve the accuracy of your return by importing your W-2 directly from your employer.

We review your tax situation for hundreds of credits and deductions to see if you qualify.

This personalized service—traditionally offered by local CPAs—is available online through eSmart Tax. Find your return easier with handsomely bound copies.

We’ll safely & securely store your return for 5 years with our Safe Keeping option. Access and print your tax returns when you need them.

Get Started and get your biggest refund fast!