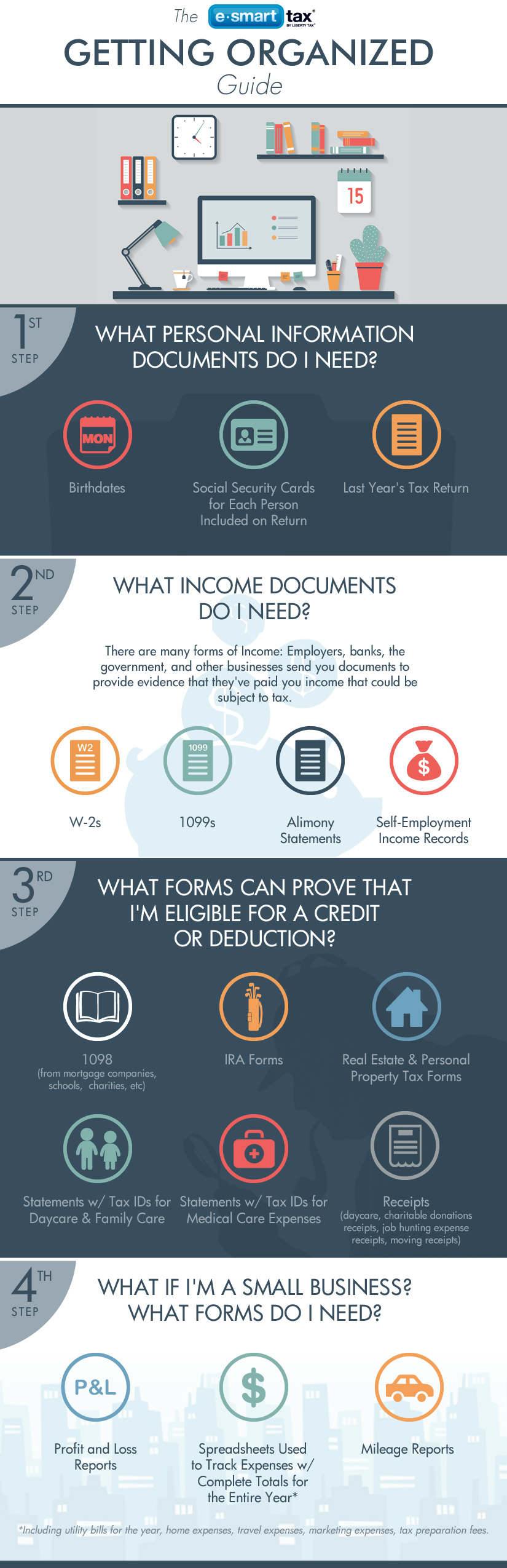

Taxes 101

Get Organized Guide

eSmart Tax is here to help you get started.

Like all important things in life, a little bit of planning can go a long way. Your tax life is much easier when you start tax season off with your key tax documents in one place. eSmart Tax’s easy reference guide can give you a starting place so you can get organized for tax season, file your return, and get back to your life.

Scroll down to read our straightforward tax guide and see what you need to start doing to submit your taxes.