Tax season is coming to an end in just a few short days. With Tax Day falling three days later this year, you have a little extra time to file. If you still can’t make this tax filing deadline, you’ll need to request an extension from the IRS. Be sure to do this by April 18, or you could face a late filing penalty.

Defining the Tax Extension

Simply put, a tax extension gives you extra time to file your taxes if you cannot submit your tax return by the deadline. An extension grants you an automatic six-month allowance and more importantly, helps you avoid a late filing penalty. You can request an IRS Tax Extension by April 18, and once received you’ll have until October 17, 2016 to file your 2015 tax return.

If You Owe the IRS

Filing an extension does NOT give you additional time to pay the taxes you owe. Estimate how much tax you owe and include that payment with Form 4868. Anything you owe will be due by the April 18 deadline, or you may face a late payment penalty. If you’re not able to pay the full amount, there are other options. The IRS allows you to set up a payment plan and make monthly payments through an installment agreement.

If the IRS Owes You

Expecting a refund? Then good news, you don’t need to file for a tax extension at all! The IRS actually gives you three years to submit your tax return and claim your refund money.

Filing for an Extension

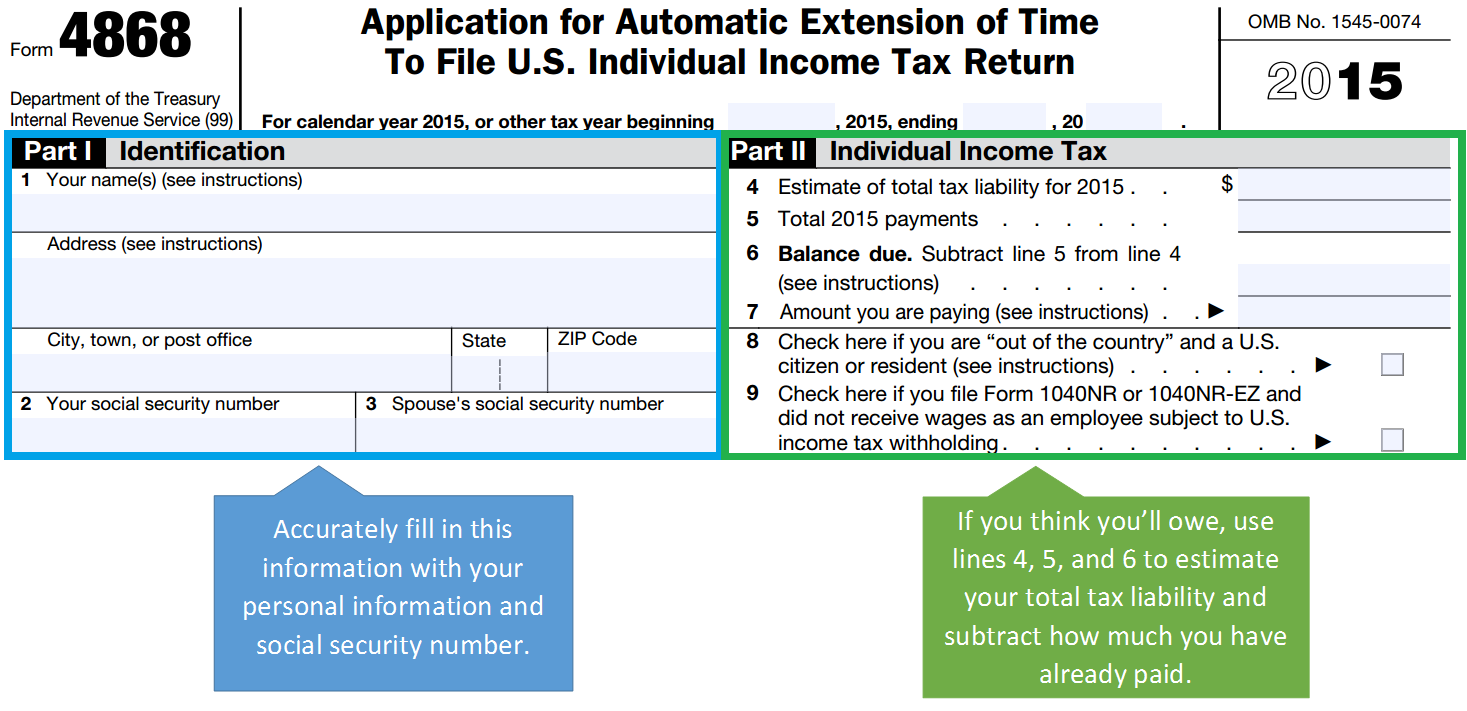

To file for an extension, you’ll need to fill out Form 4868, Application for Automatic Extension of Time to File U.S. Individual Tax Return and submit it to the IRS by April 18. We’ve given a quick overview of the form below to help you get started. For more guidance, check out our instructions on Form 4868.

File an extension for free right here on eSmart Tax! Be sure to follow us on Facebook and Twitter to stay updated on all things taxes.